The expected outcome of a coin toss is equal to the probability of heads times the outcome of heads plus the probability of tails times the outcome of tails. Early economic literature such as Knight and Keynes underlined how probabilities come in varying degrees of certainty , what we may call probability uncertainty. We propose to add another dimension to this literature by also focusing on the universe of relevant outcomes being, to varying degrees, certain or uncertain. By this we mean not the quantity of the outcome may be uncertain, but the quality.

To help clarify things consider what we may call the random generator. At the press of a button the random generator creates an object from the set of all possible objects using some unknown probability distribution. The object may be an intergalactic starship; it may be a speck of dust. Now imagine the owner of the random generator wants to sell tickets that allow people to press the button and keep whatever it produces. What would the expected outcome be? It is impossible to even try to model expectations in the face of such uncertainty.

This is what we mean by uncertainty as to the universe of possible outcomes or in short universe uncertainty.

Having thus defined universe uncertainty we can illustrate the interplay between probability uncertainty and universe uncertainty.

An entrepreneur about to start a new tech company is to a large degree unaware as to the range of possible futures that may significantly impact his business. As such what he does is not on the basis of lengthy calculation but a spur of will.

On the other hand, a speculator buying and selling stock may vary his perception as to the probability uncertainty depending on the business cycle, but the universe uncertainty stays very fixed throughout. The outcome of playing the stock market is strictly monetary in nature and has no uncertainty with regards to the universe of possible outcomes.

Since the mathematical revolution in the 1970s economics have to a large extent ignored the role of uncertainty; both with regard to probability uncertainty and completely with regard to universe uncertainty. The reason for this is partly the concept of uncertainty is impossible to formulate, but more importantly it was perhaps felt these uncertainties only existed on the fringes and didn’t matter in the aggregate.

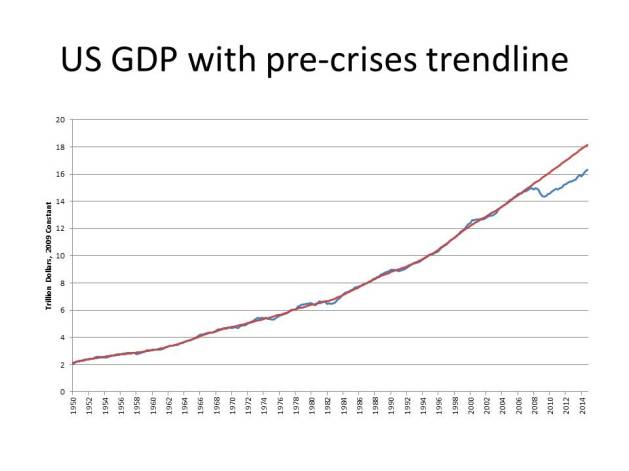

However, since the global financial crises most developed economies have failed far below their pre-crisis trend, with none looking likely to catch up the lost potential for the next 10 years. Part of that may be a shift in the general probability uncertainty and a shift in universe uncertainty.

The crisis shows that things thought to be excluded from the universe of possible events were not. Which brings the natural question; what else may be possible.

Before the crises money markets fund were safe, a euro was a euro and Europe’s affection for war had finally been solved. Naturally a producer or consumer would ask himself: Which future states of the world may I have underestimated? Which future states of the world have I not thought of?

As uncertainty leads to inaction, the lack of will leads to economic paralysis.